In this case study, learn how one company leveraged new payroll software to achieve its growth goals.

The VYRL team at VYRL (Image provided by David Perry)

Every decision you make as a small business—from your website design to your first hire—plays a pivotal role in whether you ultimately succeed or fail.

Take your first software purchase, for example. In a 2018 Capterra survey on small-business software buying trends, buyers said they spent an average of six months in each of the four stages of the buying journey (awareness, evaluation, selection, and purchase/implementation). That's two years dedicated to a single decision!

Unfortunately, all that time and research doesn't guarantee you'll make the right decision. Choose poorly, and you'll have to start all over again, blowing up technology budgets, extending timelines, and putting your small business at risk.

If you manage to make the right decision, though, success will likely follow. Here, we're highlighting one of those success stories: David Perry and his social influencer marketing startup VYRL.

David Perry

Co-founder and CEO of VYRL

By implementing Gusto, the top payroll software product from our 2019 Top 20 Payroll Software report, David was able to avoid common payroll pitfalls and grow VYRL to a 20-employee business in just 15 months.

How payroll can trip up a growing business

Payroll is a necessary evil for even the smallest businesses.

Lacking the funds to outsource this critical task, though, many businesses have to manually do payroll, in-house. This presents a slew of challenges, as VYRL experienced first-hand when initially cutting paper checks for their workers:

Rigid requirements for paying contractors created payroll inefficiencies.

A lack of shared access led to a lot of running around for information.

Being unable to administer a competitive benefits package hurt recruiting efforts.

Not only do these challenges take leadership's attention away from trying to grow the business, but they can also harm retention efforts if workers aren't compensated accurately or on-time. If it happens often enough, growing businesses become handicapped from the get-go.

The challenge for David Perry and VYRL

Having helmed other growing companies before, David learned the dangers of not locking in a scalable payroll system early on. Keeping track of accounting and payroll in spreadsheets worked at first, but quickly became time-intensive and error-prone.

“In my previous company, we got to about 60 or 70 people before we were acquired," Perry says. “What I found is that it's a mistake if you don't lock in your payroll system. If you don't go all in, you end up making this big mess that you're going to have to fix later on."

When Perry looked at Gusto for VYRL, his primary concern was: Can this scale with us as we grow?

“I was initially very cautious trying to decide if this was the right thing for us," Perry says. “If we get to 1,000 employees, can this thing handle that? I don't know."

Luckily for David and VYRL, the implementation of a payroll software solution, Gusto, has helped support their growth goals. Keep reading to learn how Gusto helped David address three payroll challenges at VYRL, and how the right payroll software features can do the same for you.

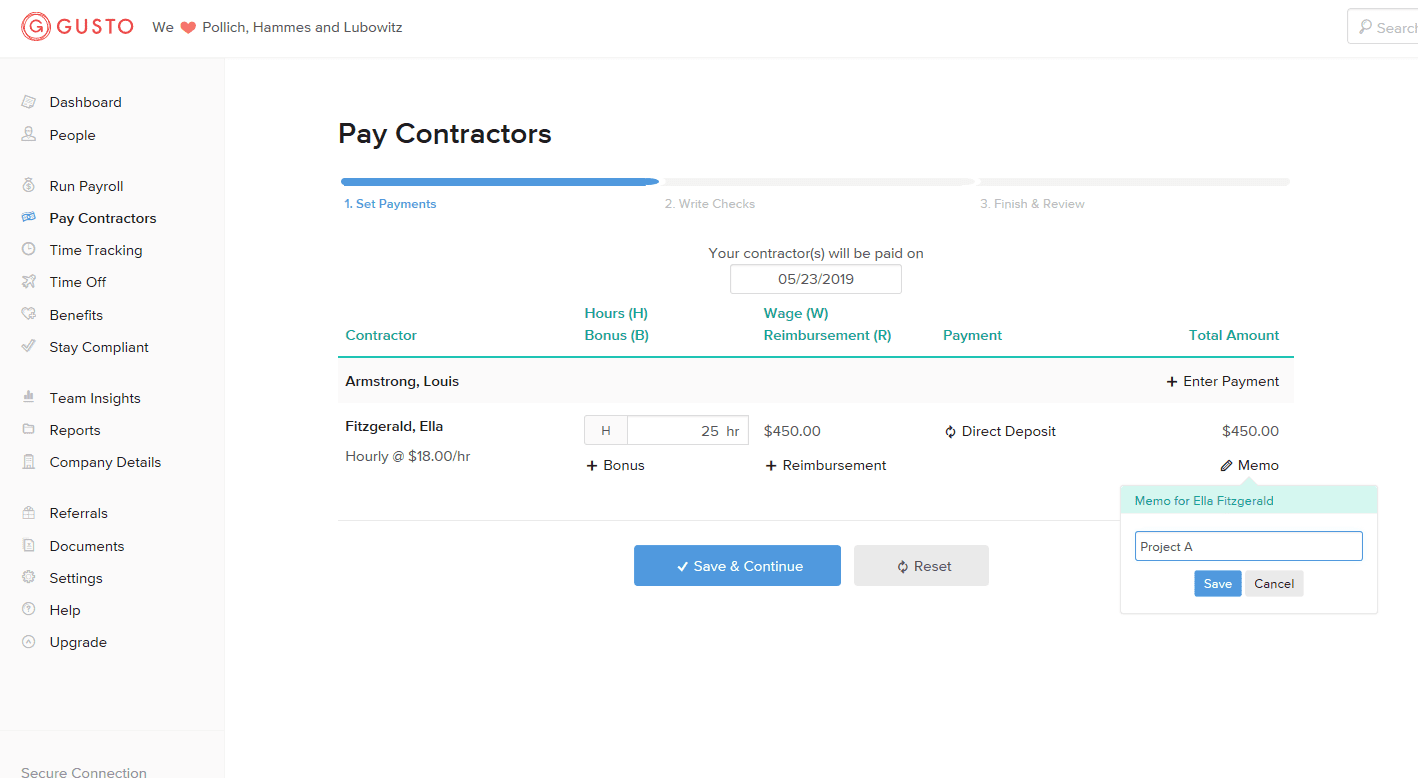

Challenge #1: Rigid requirements for paying contractors creates payroll inefficiencies

The problem: VYRL employed a number of contractors that could only be paid by invoice. The invoice would have to be passed around and signed off on by multiple people before being processed—causing unnecessary delays and creating a scattered paper trail come tax time.

The solution: An NPR poll found that 20% of jobs in the U.S. are held by contractors, and within a decade, contractors and freelancers could make up to 50% of the entire workforce.

Small businesses increasingly rely on contractors for important ad-hoc work and to fill gaps during recruiting. If you're treating the process of paying them as separate or less important than paying in-house workers, that's a mistake, as you risk things falling through the cracks.

Payroll software systems are getting better at incorporating contractor payments into normal payroll workflows. Seek out these systems to make the process less painful for your company and your contractors.

The results at VYRL

After migrating their process to Gusto, VYRL is able to be more flexible with contractor payment options (recurring contractors can be handled like hourly employees), and can also pay people within minutes. All of the payment information is housed in one place for tax purposes, as well.

“It's about as simple as it can be," Perry says. “You just type the number in, type a little memo, and you hit done, and they're paid. It's quick. You can pop in, pay someone, and get back out in moments."

Challenge #2: A lack of shared access leads to a lot of running around for information

The problem: In the past, if the accountant needed to see payroll reports, or if a worker needed to update their payment information, the responsibility fell on one person at VYRL to make it happen. It was incredibly time-consuming.

The solution: Relying on manual methods for payroll eventually leads to the problem of the payroll “gatekeeper." If you need to update your pay information, you have to go through the gatekeeper. Same if you need a payroll expense report.

Self-service capabilities in payroll software solve this problem by democratizing these duties to everyone, without any security risks. Workers can only see the pay information relevant to them; same with accountants.

The results at VYRL

Now, through Gusto's self-service features, the accountant can download reports when they need to, and employees can view and update their payment information themselves.

“If you can imagine the number of people who need the ability to use the platform, they all have access," Perry says. “That's reduced some of the workload, knowing everyone has what they need all of the time. I'm not having to chase down anyone for anything."

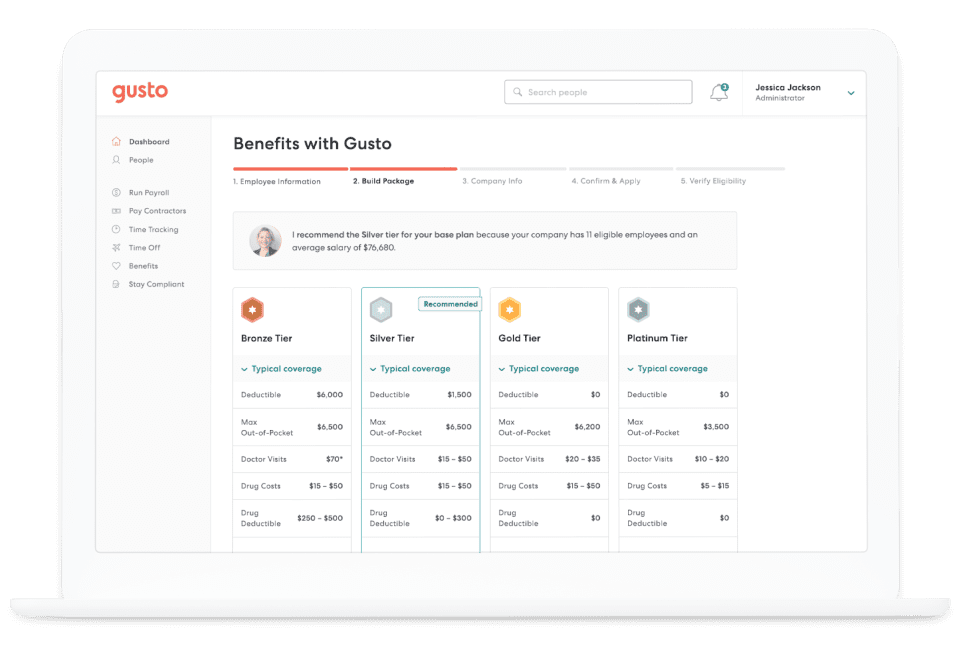

Challenge #3: Being unable to administer a competitive benefits package hurts recruiting efforts

The problem: If VYRL wanted to hire someone with a family, the lack of health benefits was often a deal breaker.

The solution: Though the letter of the law says you don't need to offer health insurance to workers until you reach the 50 full-time equivalent (FTE) employee mark, that doesn't negate the fact that job seekers really want insurance at their next gig—and you're competing against bigger companies that offer it.

What's getting in the way of you offering a competitive benefits package? Cost, for one thing. But also the administrative burden of creating benefits packages, determining eligibility, tracking enrollment and compliance, and generating necessary reports.

It's a nightmare to do manually, which is why you should invest in payroll software with a benefits administration application. These platforms streamline and digitize the whole benefits process, lowering costs, and helping you attract top talent.

The results at VYRL

Now, through Gusto's benefits offering as both a benefits broker and an administration platform, VYRL is able to offer health insurance to workers. This has allowed them to be more competitive in the talent market, hiring more people and growing at a more desired pace.

“The team has been very, very happy with the benefits program that was put together," Perry says. “Healthcare is a big deal, especially if someone has a family or they're moving from somewhere else. That's going to help me with recruitment."

As an added bonus, because VYRL already had all of their employees in the system, David didn't have to re-enter any new information, and all of that benefits data is immediately folded into the payroll process.

“I'm trying to remember if I filled out a single piece of paper to get the whole thing running, and I don't think I did," Perry says.

It pays to explore new options

As cautious as he was initially, Perry now credits Gusto with helping him grow his business. But he admits it wouldn't have happened if he hadn't challenged some of his preconceived notions.

“I find myself constantly leaning on stuff from my past," Perry says. “It would've been so easy for me to choose one of the old-school firms that's been around for 30 years that I've used in the past, but that's not the right decision for the company."

Using Gusto, David and VYRL were able to streamline contractor payments, spread out the payroll effort amongst the team, and offer competitive benefits to job seekers. You can have similar results if you broaden your horizons to find the right payroll software for your needs.

“I think this is something most managers and CEOs need to do," Perry says. “You need to understand that this stuff is moving fast. In every field, there's so much innovation that you have to embrace it."

Check out our 2019 Top 20 Payroll Software report to discover which payroll solutions made it to the top of our rankings. You can also learn more about our Top 20 reports here.

Thinking about hiring a payroll service provider for your business needs? Browse our list of top payroll service providers and learn more about their features in our hiring guide.