Read our guide to find out how a payroll ledger can help your company streamline payroll processes.

Payroll is one of the most significant elements of your overhead, so it’s important to keep accurate records. In addition, if your company ever gets audited, the auditor may ask to see your payroll ledger. And, as is the case with most records, your payroll ledger may play an important role during the due diligence phase of a merger or acquisition. There are several other compelling reasons to maintain a clean, consistent payroll ledger, including the internal analysis of financial systems and practices, so it’s helpful to know what a payroll ledger is, why you need it, how to use one and how to make one.

Find providers that can help with your business needs by using our lists of payroll services by location.

What is a payroll ledger?

A payroll ledger refers to a tool used to track payment data for your employees, businesses you pay, and private contractors. In other words, your payroll ledger should include information about payments made to any person or entity that receives funds from your payroll department.

A company can choose to maintain multiple payroll ledgers, as well. For example, you may have one for internal employees and short-term contractors and another ledger for business entities. This can be particularly useful when entering tax information, especially because the taxes you have to deduct may be similar between individuals yet very different from those you deduct for business entities.

That being said, it may be just as valuable, for the sake of simplicity, to keep one payroll ledger for all payments. Regardless of how many payroll ledgers you have, the key is to make sure your accounting system integrates all of them consistently, which helps avoid inaccuracies and difficulties during the reconciliation process.

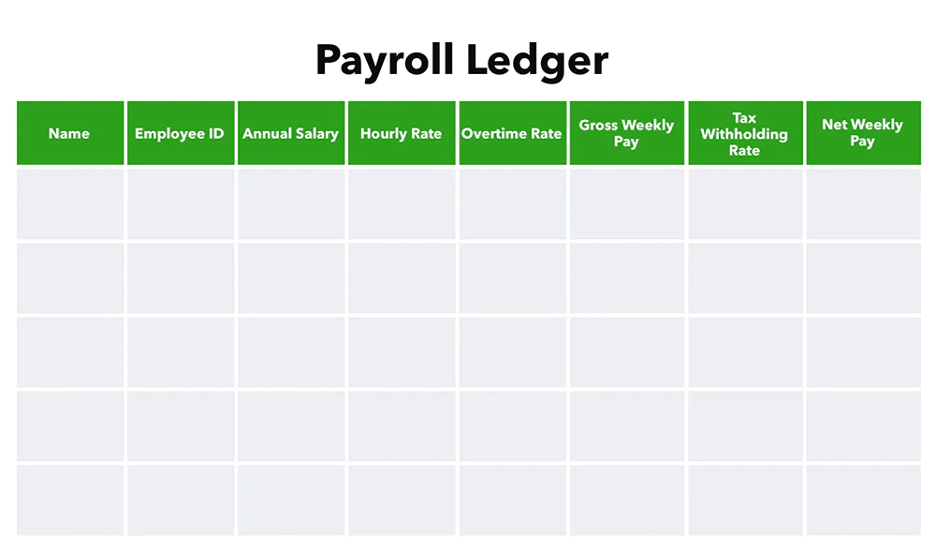

Payroll ledger example (Source)

Why do you need a payroll ledger?

Payroll ledgers are important for keeping track of data regarding the money you pay to different people and entities. This includes payments to employees, contractors, tax agencies, insurance companies, other businesses, and others. Using a payroll ledger makes it easier to keep track of who you’ve paid, when, and the various deductions you had to make.

You can also use a payroll ledger to get a quick glimpse of which accounts you’ve paid and how much you’ve paid out over time. In addition, you can organize your payroll ledger in a way that enables you to produce statements regarding how much you’ve paid individual people and entities.

These statements are also valuable when analyzing the amounts you deduct for taxes and other deductions. Some finance managers also use a payroll ledger to analyze how much money gets paid out over specific time periods, such as during specific months or quarters.

How do you use a payroll ledger?

Even though every business uses a payroll ledger differently, here are some general practices to ensure you get the most out of it while simplifying and standardizing your accounting practices.

Stick to a regular entry schedule

By setting up routines around when you enter data in your payroll ledger, you can avoid mistakes and ensure that your payroll data is complete. The important thing is to set up a system and adhere to it no matter what comes up.

For example, some businesses update their payroll ledger every week. Others may choose to do it once a month. Regardless of how frequently you update your payroll data, you want to make this a priority for your accounting team. For some organizations, prioritizing payroll ledger entries involves setting aside a specific day and dedicating it solely to that task. This may mean that you have to handle account reconciliations and other important financial record-keeping on a different day.

Consistently transfer payroll records to your general ledger

Even though smaller businesses may keep people’s records within their general ledger, many differentiate the two, which makes it necessary to transfer payroll data periodically. By doing this consistently, you ensure that your payroll expenses get combined with other overhead costs. This way, you don’t have to worry about payroll figures throwing off financial assessments or projections.

Use a comprehensive array of categories

One of the most crucial elements to keep in mind when it comes to making the best use of your payroll ledger is to set up enough categories or columns to ensure your ledger accounts for every kind of payment you have to make. Without enough categories, your accounting staff may find itself mislabeling some payments or deductions. This could make it extremely difficult to analyze the kinds of expenditures and deductions the business makes.

For example, in addition to each employee’s name, you should also include their position and whether they’re a full-time or part-time employee. It’s also helpful to enter the pay rate for each employee, and if some employees get paid at a different time or according to a different schedule than others, you should indicate this as well.

For example, suppose you pay a consultant on a net-30 basis, but you pay regular employees once every week. In this case, you could set up a “When Paid” column and put “Net-30” for the consultant and “Weekly” for each regular employee.

Design your ledger with data analysis in mind

Data is 21st-century gold, and your payroll ledger can, when set up properly, be its own little gold mine. But to make it a useful business analytics resource, you need to set up your fields with a mind to how you can use the data in the future.

This looks very different for each company and depends on the financial management metrics you value most. For some organizations, running leaner operations is a priority. Perhaps you’ve set up a metric to measure how much you save when it comes to payroll over a specific time period, such as a quarter. This is relatively straightforward to track using the date field of your ledger.

But suppose you have a distributed workforce and want to analyze the relationship between the pay rates for employees from different regions of the country or the world. This could be useful if you’re trying to achieve pay equity. On the other hand, you could use this type of analysis to find ways to reduce your overhead by hiring employees that live in economies where a lower salary is more than enough to make a living wage.

Regardless of your reasoning, you would want to add a column such as “Geographic Region,” “Country,” or “Zip Code” to your ledger. You could even take things a step further and use an application programming interface (API) that provides geolocation data and integrate it with the data in that column.

The analytical possibilities are endless—as long as you set up your ledger just right.

Making a payroll ledger is fairly straightforward if you have a basic word-processing or spreadsheet app and know the different columns you need.

Here’s how to set up a very basic payroll ledger:

1. Open a spreadsheet app—or even a word processing app—and create a six-column table. To do this in Microsoft Word, for example, you can use Insert—Table and select six columns. The process is similar in other word-processing apps. But keep in mind that if you want to analyze your data, you’ll need a spreadsheet capable of handling calculations.

2. Your first column could be labeled “Employee Name.” You can include both the first and last names in the same field.

3. Your second column will have the label “Pay Period.” You will enter these as beginning and ending pay dates using the following format: MM/DD/YYYY – MM/DD/YYYY.

4. For your third column, you can label it “Gross Pay” or “Pay,” whichever works best for you. This will indicate the amount you pay employees before deducting taxes.

5. The fourth column should be labeled “Deducted Taxes.” In this column, you’ll enter state, local, and federal taxes that you deduct from your employee’s pay.

6. For the fifth column, you should name it “Additional Deductions” because this is where you will enter deductions, such as those for retirement accounts and health insurance.

7. The sixth column will be labeled “Net Pay,” and it will indicate the amount the employee gets after all taxes and other deductions have been taken out.

8. Add additional columns as needed.

Creating payroll ledgers using software

Granted, the above ledger may only work for businesses with very straightforward payroll systems. By using software, you get pre-existing payroll systems that you can also customize according to your needs.

In addition, with payroll software, you can get:

The ability to integrate payroll data with timesheets.

The freedom to run reports and customize the kinds of data you report out.

The ability to produce charts and graphs showing payroll data and trends over time.

The option of integrating your payroll ledger with your payment system, so checks get sent out automatically after you’ve confirmed the data in your payroll ledger.

Your payroll ledger can be more than a way to keep track of payment information. You can use it to analyze spending trends and correlate payroll data with business outcomes. If you keep your payroll ledger up-to-date and include the right fields, it can be a powerful element of your accounting—and business intelligence—system.

If you’d like to streamline your payroll or find new ways to make it more efficient, hiring a service provider can help your company improve its payroll processes. Browse our list of top payroll service providers and learn more about their services in Capterra’s hiring guide.