Insights from accounting software users, Capterra advisors, and 1,000+ systems in our database show what you need to know.

If you’re searching for accounting software, you’re likely tired of wrestling with spreadsheets to keep track of business expenses and profits. Accounting software could be the solution to your bookkeeping woes, but you need to know the technology’s potential and limitations to invest in the right product.

To give your small business a firsthand account of what it’s like to use accounting systems, we spoke with Joan Kanner, a bakery owner who switched from manual methods to accounting software. [1] We also consulted Capterra software advisor Niko Bernardone [2] to understand how you should navigate this market to find software that actually meets your needs.

“The more decisions we made based on our revenue streams, the more we needed to move from spreadsheets to something more dynamic and searchable like accounting software.”

Joan Kanner

Co-founder of Bottoms Up Bagels

What is accounting software, and why is it important?

Accounting software helps your business keep track of money. It simplifies and organizes financial tasks such as recording sales, tracking expenses, sending invoices, and calculating taxes.

It’s like an in-house digital bookkeeper who securely accesses financial information from bank statements, credit card data, and cash receipts to log money coming in and going out, and regularly reconciles these records with bank accounts.

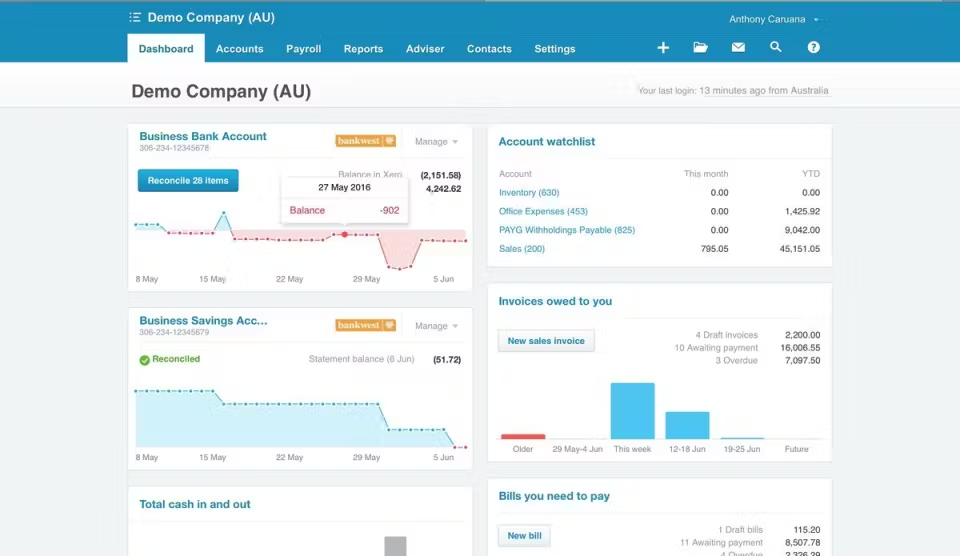

Dashboard view in accounting platform Xero

Accounting solutions, like the one shown above, typically provide general ledger, accounts receivable, accounts payable, and reconciliation capabilities. They also allow you to generate comprehensive, real-time, and on-demand reports on company performance.

Accounting tools reduce the time it takes to record, categorize, and label financial data manually so you can spend more time analyzing and reviewing that data to make sense of it.

Who uses accounting software?

Business owners, accountants, and bookkeepers typically use accounting software to maintain accurate financial records, monitor expenses, and manage company finances more effectively. The chart below highlights the top industries that accounting software buyers who contact our advisors come from.*

Types of accounting software

Capterra has nearly 1,060 products listed in its accounting software category. With hundreds of options available, it’s crucial to understand what different types of accounting software offer.

For a small business, it’s common to begin with a generic accounting system. Bernardone explains that a basic solution with core functionality such as general ledger, accounts receivable, and accounts payable is usually a good starting point for first-time software buyers. However, this could change when you factor in industry-specific needs.

“If a new business in the food industry is looking for some sort of accounting software, first I would see if they qualify for the retail market rather than accounting. Because it’s possible they’ll need a point of sales (POS) system too. If so, an accounting system integrated well with POS will work better and be more seamless for their business.”

Niko Bernardone

Software advisor at Capterra

Depending on your business needs, you can choose from three types of accounting systems:

Core accounting systems: These are basic solutions that fulfill essential accounting needs, such as general ledger, accounts receivable, and accounts payable, and are offered in almost all products in this category.

Advanced accounting systems: These are designed for growing and large businesses and offer advanced features such as budgeting and forecasting, expense management, billing and invoicing, and specialized accounts payable or accounts receivable modules.

Niche accounting applications: These are specialized tools that cater to specific industries or functions, such as nonprofit accounting software to track donations, lease accounting software for property buyers, and project accounting software to manage project income and expenses.

Want to know which accounting software is apt for your growth stage and industry? In one short phone call, get a personalized list of five software options that fit your needs. Schedule a free consultation with our advisors.

Key features of accounting software

As discussed earlier, general ledger, accounts payable and receivable, and bank reconciliation are basic features in all accounting tools. Expense tracking, billing and invoicing, financial reporting, budgeting, and forecasting are also common.

We asked accounting software reviewers on Capterra to rate the most important features. Here are the three most critical features, according to verified software reviewers.**

Feature | Description | % of reviewers on Capterra who rate it as critical or highly important |

|---|---|---|

Income and balance sheet | A statement detailing your business’s financial position, including assets, liabilities, and equity at a certain point in time. | 93% |

Financial reporting | A module that generates detailed reports evaluating the financial performance of your organization. | 91% |

General ledger | A centralized accounting record book that tracks all financial transactions within your business. | 86% |

Bernardone notes that most buyers looking for accounting software are moving on from spreadsheets and have basic needs. “Features often demanded by buyers are core functionality like general ledger and income and expense tracking. Advanced features dealing specifically with budgeting, forecasting, and expense management take on special importance as businesses grow or experience disruption.”

Benefits of accounting software

Kanner says she loves accounting software’s ability to easily capture and record paper receipts in the ledger, simplifying and automating financial management. “This gives valuable time back to us and keeps our projections up to date. I can analyze how we’re doing in terms of revenue from different sources—in-store sales, events, and hospitals. The fact that we, as nonaccountants, can ask these questions and have the software provide answers was revolutionary for us,” she shares.

The table below lists a few more benefits of accounting software as well as excerpts from related accounting software reviews on Capterra.

Benefit | Description | Review excerpt |

|---|---|---|

Generates customizable performance reports | Many accounting tools offer customizable reporting capabilities to meet specific user needs. You can customize the dashboard or interface to capture relevant performance indicators for your teams. | “I appreciate the flexibility it offers in creating custom financial reports, providing a tailored view of our organization's financial health.” – Lillian G., HR generalist, healthcare |

Automates accounting processes

| Most accounting tools can automate financial tasks such as capturing data from receipts and invoices, sending reminders to defaulting customers, and reconciling accounting records with bank accounts. | “It has helped us automate over 90% of our daily accounting processes, such as receivables management and general ledger bookkeeping.” – Emily M., collections manager, financial services |

Supports small-business growth | Accounting software is particularly valuable if you’re a growing small business. It provides critical functional support for noncore operations, such as taxes and payroll, without requiring you to hire full-time experts. | “By encouraging us to learn how to use the system and how to use the learning resource available we are able to make small improvements and changes to our system without having to engage a consultant, saving our business time and money.” – Kylie W., financial controller, electronic manufacturing |

Click here to learn more about accounting software benefits.

/CASE STUDY

Benefits of combining accounting software and services

Despite being in the food industry where cash payments and informal bookkeeping practices are common, Kanner wanted to maintain meticulous financial records to apply for small-business grants, investments, and loans.

She took a dual approach to handling her business’s accounting. She adopted accounting software that gave her methodical control over finances without needing deep accounting expertise. Additionally, she arranged for quarterly consultations with a professional accountant.

Accounting software made it easier for Bottoms Up Bagels to record cash receipts, send invoices, and track expenses. “Most importantly, it provided me a shared language for discussions with the accountant,” says Kanner. “I could tell my accountant that a food expense was a meals and entertainment charge as we took the team out for lunch, and he would tell me it’s 100% reimbursable as he could tie in the tax implications for those line items.”

This approach paid off big time during the pandemic. With clear, accessible financial records, Kanner successfully secured federal and state grants. “Having the right accounting consultant means you’ll get your money back through their tax expertise, and using accounting software means they’ll respect your business decisions and help you make better ones.” Her advice? Don’t go past a year without getting a reliable accounting software and accounting consultant for your business.

Considerations when looking for accounting software

According to Capterra’s 2024 Tech Trends Survey, 60% of software buyers regret at least one purchase made in the last 12 to 18 months.*** Approaching software selection thoughtfully is critical to ensure the software you buy fulfills your requirements. Here are a few key factors to keep in mind during software selection:

1. Integrations

You’ll likely need additional applications on top of your standard accounting software to manage finances. Ensure those apps can play well with your chosen accounting software. Accounting software users usually integrate their software with payroll, timekeeping, inventory management, and point of sale (POS) systems.

“With patchy integrations, everything that needed to take two steps was taking five steps and it made me feel less confident of our first software,” shares Kanner.

What to do? Every business faces unique challenges. Discuss your needs with an advisor to understand which integrations are essential for your current situation. Additionally, bring up the integration conversation in the first meeting with the vendor. Ask if they provide these additional tools or can integrate your in-house applications with their software.

“Many accounting systems offer payroll, but it’s through a partner integration. If payroll is a concern, buyers should discuss this with vendors early on.”

Niko Bernardone

2. Budget

Most accounting products on the market are priced monthly, with entry-level plans averaging $144 per month for one to four users. Premium and advanced subscriptions typically cost around $312 per month.**** But remember, the sticker price isn’t always the final cost.

Additional expenses such as setup fees—where the vendor sets up the system and migrates your data from your old system—can be significant. “That’s probably one of the biggest additional expenses,” says Bendarman. “If you’re looking for an on-premise solution, you may have to pay 10% to 15% of maintenance fees since it’s not constantly updating like the cloud.” Training and support could also incur additional costs in some cases.

More than half (52%) of the accounting software buyers Capterra advisors spoke to over the past year budget less than $210 per month for software purchase.*

What to do? Prioritize user experience. Bernardone advises not to be overly price-cautious initially. “We find that buyers are often willing to pay more for a system if it has the right features and best user experience.” This isn’t surprising, as ease of use is the #1 driver of satisfaction for almost 70% of accounting users.***

Bernardone also recommends doing two to three demos with a vendor to experience the system. “While all accounting software tools you shortlist will have the same features you’re looking for, the difference is going to be in the user experience. Learn from the first demo, and apply it to the second and third.”

Opt for a product demo before taking a free trial. Free trials are limited, whereas demos show all the bells and whistles you need for your business. They also give you a chance to ask questions to someone who knows the system.

3. Deployment options

You’ll generally have two main deployment options: cloud and on-premise. Cloud-based accounting systems offer unparalleled flexibility and scalability. You can share and update data from anywhere, making these online accounting software tools an excellent foundation for business growth.

On-premise solutions offer greater control, as the data is housed on your local servers. However, this option comes with higher upfront and maintenance costs. Bernardone mentions that most software systems are transitioning away from on-premise tools: “Programs that haven’t moved to the cloud yet are now starting to.”

What to do? For most small businesses, opting for cloud accounting software will offer more advantages. It’ll give you a wide range of software products to choose from and allow your team to collaborate and communicate on workflows from any location or device, including mobile.

However, if you’re a large organization with stringent data security requirements, an on-premise accounting program might be a better fit. Keep in mind the additional infrastructure, maintenance, and personnel costs that come with this choice.

Ready to start your search for accounting software?

Finding the right accounting software isn’t a one-size-fits-all process. Talking to our advisors can cut your software research time down in half. “In our first conversation itself, we give you a list of five potential solutions tailored to your business type and needs—all in just 15 minutes,” says Bernardone.

Schedule your free software consultation with a Capterra advisor today.

If you’re not ready for a consultation yet, check out Capterra Shortlist for accounting software, which identifies the top accounting systems based on user ratings and popularity. Compare different products to see how they stack up against each other.